Get a clear look at what you’re paying and how much risk you’re taking. This complimentary review helps identify your portfolio’s costs, risk exposure, and opportunities to better align your investments with your goals — all with no obligation.

Get Started

3Q2025 saw a continued rally following the initial volatility experienced during 2Q2025.

While there were pockets of volatility and uncertainty during the quarter, multiple reasons led to a sense of renewed confidence heading into the final quarter of 2025 and the full year 2026.

U.S. equities finished the quarter on a firm footing: the S&P 500 advanced ~7.8% and the Nasdaq gained ~11.2% for 3Q 2025, supported by ongoing strength in AI-linked mega caps and a late-quarter broadening into cyclicals and small caps.

September itself added another leg higher as volatility stayed manageable and oil drifted lower, easing input-cost concerns.

Participation improved versus mid-summer: beyond large-cap tech, we saw more consistent contributions from industrials, financials, and select small caps, with defensives mixed as rates stabilized.

While overall valuations remain elevated, margins and free-cash-flow quality held up, particularly among the platform leaders that continue to benefit from secular AI/data-center capex and productivity themes.

Headline and core inflation trended closer to ~3% y/y through late Q3—well below 2022–23 peaks but still above the Fed’s 2% target (PCE).

Labor softened at the margin, with unemployment near 4.3% and slower monthly payroll gains—consistent with late-cycle cooling rather than a break in underlying demand.

This mix of cooler inflation, softer labor, and decent corporate results kept risk appetite constructive and reinforced the Fed’s data-dependent stance.

At the September meeting, the FOMC cut 25 bps (to a 4.00–4.25% target range) and signaled openness to incremental easing if inflation progresses and labor softens.

Into year-end, futures markets broadly anticipate two more 25 bp cuts (October and December), with further normalization in 2026 contingent on the data.

The result has been a front-end–led decline in rates and a modest re-steepening of the curve from deeply inverted levels—conditions that generally support risk assets, tighten credit spreads, and ease financial conditions without implying an outright growth surge (which helps keep inflation risks contained).

As we entered 4Q2025, the federal government began its shutdown, which has delayed key data releases (e.g., BLS Employment Situation, JOLTS, Inflationary Data).

This action may likely lower response rates, increase subsequent revisions, and widen confidence intervals once agencies resume.

For the FOMC, thinner and delayed data complicate meeting-to-meeting calibration and may create a situation where voting members opt to pause rather than act; for markets, it raises the headline-risk premium around each print when it finally drops.

From a practical standpoint, we expect policymakers to lean more on private proxies in the interim and to stress data dependence even more explicitly.

For portfolios, this argues for discipline around position sizing and liquidity, continued focus on quality balance sheets, and readiness to use volatility—on either policy or data surprises—to make decisive proactive decisions.

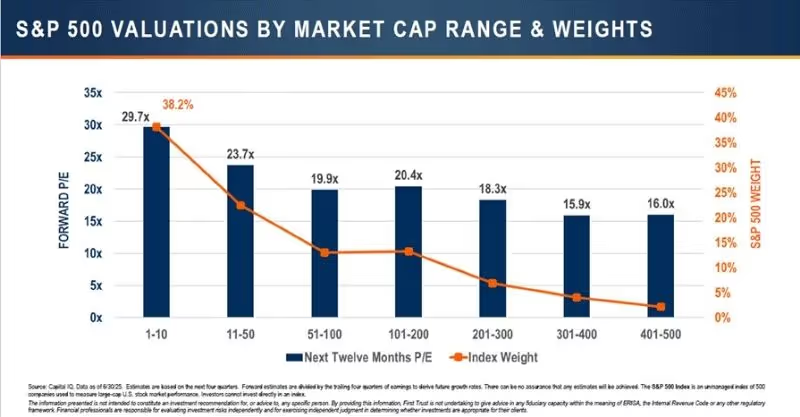

Many solid U.S. companies outside the biggest names remain attractively priced given steady cash flows and strong balance sheets.

While the media focus has been on the largest market capitalization names (e.g., NVDA, MSFT, GOOGL, AMZN), we continue to find relative value across the rest of the S&P 500.

Our comprehensive due diligence process emphasizes growth at a reasonable price: businesses that generate healthy cash, earn well above their cost of capital, carry manageable leverage, and show improving earnings trends—so returns can come from both earnings growth and a sensible re-rating, not just multiple expansion.

As we enter the final quarter of 2025, the combination of moderating inflation, a data-dependent Fed, and resilient corporate fundamentals supports a constructive—yet selective—outlook for 4Q25 and a positive setup for 2026.

We will continue to emphasize quality and cash-flow durability, lean into opportunities where valuation and revisions align, and act decisively when volatility creates mispricing.

Above all, we remain steadfast in our commitment to delivering you Financial Peace of Mind through transparent communication, disciplined risk management, and a well-thought-out approach designed to help you achieve your long-term goals.

We look forward to seeing you soon and wish you and your families a wonderful start to the holiday season!